Avocados or Carrots? Creating a Neo-bank That Cares How Young People Think and Manage Money

In partnership with an Australian financial organisation, we set out to discover how everyday Millennials and GenX manage their money. This included moves between apps, banks and accounts, as well as their short-term and long-term thinking that underpins their money life. Money for these overlapping generations can be mercurial—both a liberation and a prison.

Feedback

“The team at Cognitive Ink was an absolute pleasure to work with. Both Christopher and Anna have a tremendous skill for connecting with customers and building confidence and trust. Cognitive Ink have a unique approach to engaging customers and creating an interactive experience. If you need some help connecting with what customers really want, they’ll certainly be able to help.”

Successes

Surfaced genuine customer voices: By engaging deeply with potential end-customers, we learned how they thought about finances, both their daily money and long-term strategies. We created rich maps of real-world behaviour, that provided crucial strategic guidance for the new product, service, and experience model being developed by our client.

Unified the leadership on customer needs: We presented our insights to the entire leadership team, including head of innovation, design, technology, product, marketing, and the incoming chairperson. This high-level access meant we could provide a unifying perspective on where the new organisation could focus its efforts.

Offered a cost-effective exploration of the future: By using fast-iterating sketches and storytelling assets, we helped the organisation explore a future experience using our research. This helped bring insights to life, before the team deployed significant resources to build all the components.

Challenge

Australian banks often target older and wealthier customers with many of their products and services. A focus on this powerful cohort can deliver strong experiences and high value: big mortgages, life insurance, large savings accounts and self-managed superannuation.

However, organisations focused this way end up setting aside the large population of up-and-coming customers—GenX, Millennials, Zoomers and Alphas—who may need more adaptive support. Their lives are more financially complicated by context, changing circumstances, and difficult macroeconomic events.

Luckily, our client was interested in exploring a different sort of banking experience. An approach that was digital from the ground-up, responsive to the needs of younger generations and sensitive to the unique challenges posed by those maturing in one of the most difficult financial climates in decades.

In this aim, our client engaged us for a single cycle of face-to-face Human-Centred Design research with real people, as well as the follow-on insight and experience ideation to follow.

Approach & Deliverables

We explored a range of different research methods to engage with potential customers, eventually settling on long, loose-structured interview sessions.

Our recruitment focused on: Young Millennials (20-30 years old), Mid Millennials (30-35 years old) and Young Gen X (35-45 years old), with incomes ranging from 60,000 to 90,000. We selected people who were more active with online banking and apps.

We designed the flexible agenda to explore people’s:

Background: What sort of life are people living? Who are they living with and how do they relate to money?

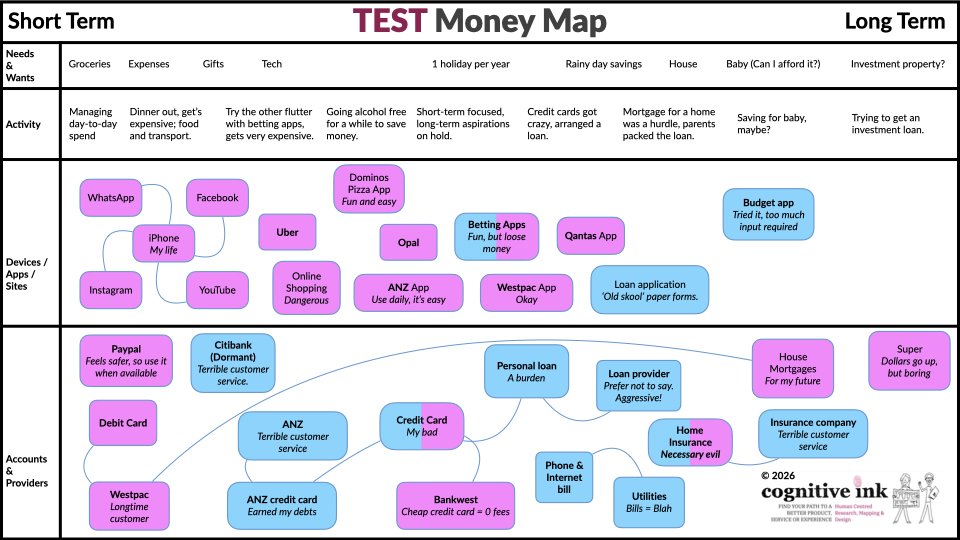

Money Map: What does the financial map of someone’s life look like? What parts of their personal financial maps cause them the most pain, frustration, and dissonance? How do their current banking institutions help, and where do they look for insight?

Possible Futures: What do people think about four alternate money-futures, especially on issues of trust, privacy and cost?

After conducting the research, we packaged the information into a concise-but-powerful summary of the insights, big ideas, money maps and people’s reactions to the money-management futures.

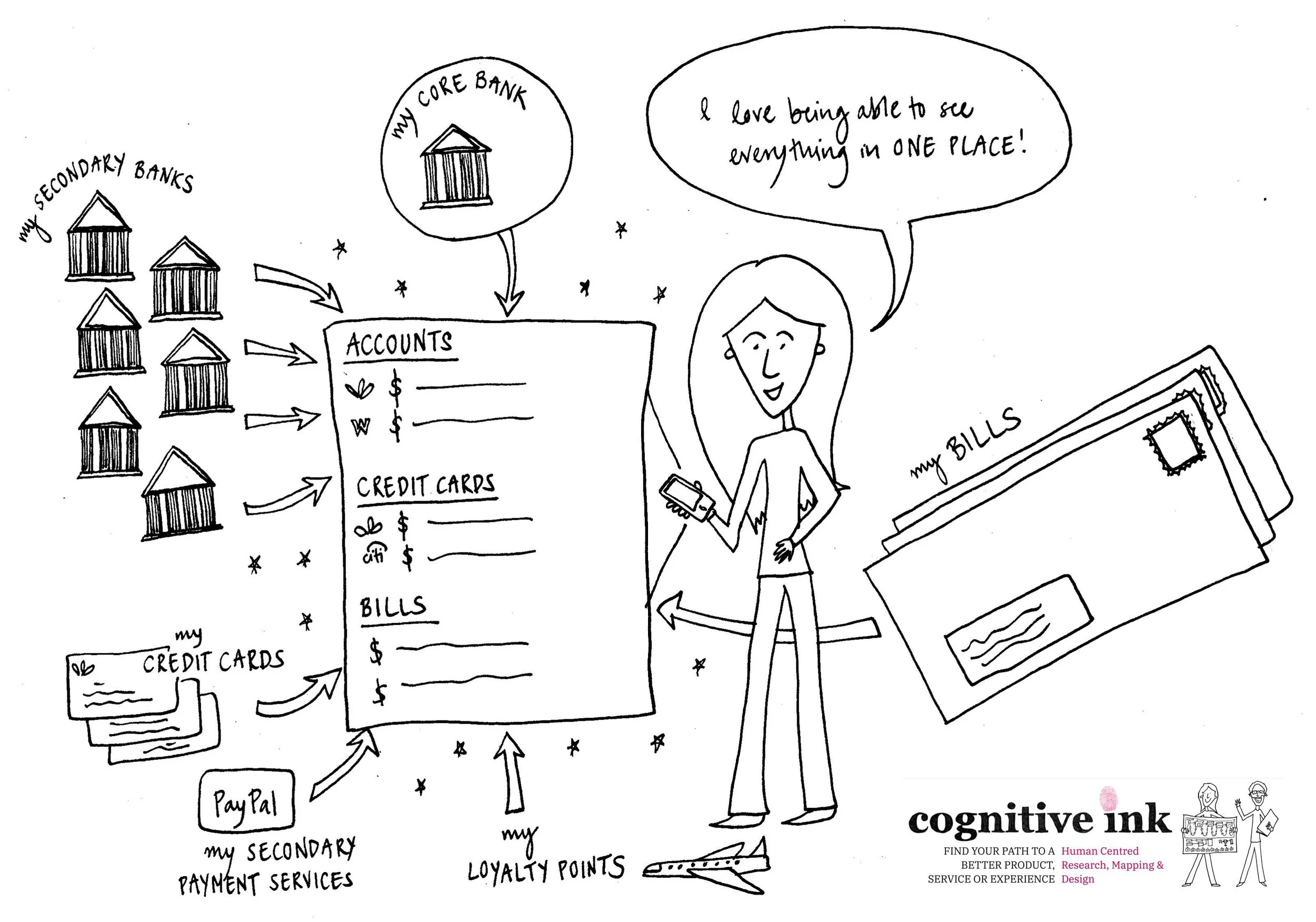

Finally, to bring the insights to life, we created a lightweight sketch and text-based storyboard that showed how the various ideas explored in sessions could emerge during a day-in-the-life of a future banking customer.

Insights & Outcomes

After interviews, we synthesised hundreds of quotes, pictures, and dozens of money maps to discover a powerful set of key insights and opportunities that would lead to radical experience improvements in how people could budget, spend, and save.

Potential customers were deeply engaged with the process, and we heard many emotive stories about how they balanced the tension between money limitations and aspirational lifestyles.

For example, consider Kurt* and his tough experiences with money.

*Names, details and descriptions obscured and aggregated for privacy reasons.

Kurt, thirty-four, speaks very reservedly. He takes a long time to reach for the sandwiches we’ve put out, but when he leaves he takes a few extra so he has something to eat later. It’s hard to get him to talk. It’s late in the evening and he’s tired after a long day at work. He was recently made redundant, so he’s just settling into a new operations role. Some of his first words are, ‘I hate money’. Money has always been mercurial to him. It comes and, all too often, it goes.

He budgets sometimes, but then splurges on bigger expenses that cause quite a strain on his finances. Like nights out with his friends, or new clothes. Kurt wants to do better with his money, but hasn’t yet made any changes.

Kurt doesn’t have much trust for the world of money and the people who manage it: banks, insurance companies, and small loan enterprises. He feels like his finances are a window into who he is, and he doesn’t want them to have that knowledge. He isn’t sure about the motives of the people who might help.

Kurt has family responsibilities and dreams for a better future, but no clear path to achieve them. Without change, Kurt will keep going as he is, neither losing too much, but also gaining very little. Money will always be tight and growth will be self-sabotaged by those moments of extravagance, chasing one more evening out with friends.

In contrast, Danielle* was hyperconfident, self-managed and precise:

*Names, details and descriptions obscured and/or aggregated for privacy reasons.

It shows up in her elegant clothing, fast speech and careful interrogation of the context of the session before we start. She doesn’t have a very high-paying or high-responsibility role, but she describes how this is by choice. Her goal is to attain financial independence as soon as possible. With some help from her parents, she’s on her way there.

She likes to travel and admits she likes a few nice things, but is still very careful with her expenditure so she can achieve this goal of independence. She’s tried using the tools offered by a few banks, but has generally found them lacking.

She dismisses them with a wave of her hand and then delights in talking for some time about her spreadsheets, which she uses to track the breadth of her finances.

Overall, real people’s finances are spread across a web of banks and other financial institutions, with one major bank serving as their ‘money core’. This isn’t by design, but just the slow aggregation of products from an early age.

Millennials and GenX expect cutting-edge online services, but they also don’t let this service as an excuse for poor customer service. People cling tightly to their favorite financial institution, even when this relationship becomes less effective. Granted, people are self-aware enough to know that banks make use of this inertia.

When looking to the future, and especially when faced with the breadth and complexity of their own money maps, people are desperate to make things simpler, safer, and more financially effective.

Millennials know well that their short-term thinking frequently damages long-term advantage, but circumstances often trap them between the metaphorical ‘rock and a hard place,’ leaving them without sufficient momentum (or support) to escape short-term money management.

Because of the strategic nature of the insights, we took the lead in presenting our work to the business leadership, product management, and incoming chairperson.

Ultimately, our research insights helped inform the early pre-build development of a ‘neo-bank’ of the future.