How’s My Money Going? Using Software To Create More Meaningful Financial Advice Reviews

In partnership with one of Australia’s leading providers of financial advice software, we dove deep into understanding the experience of carrying out financial advice reviews. Sometimes treated as little more than a mandatory checkpoint, advice reviews are a key time to align the expectations of clients and the capabilities of advisers.

Feedback

“This is absolute gold when it comes to knowing what to do next and building a solid business case.”

“When I was contacted to do this… one of the things I did appreciate is that they are taking the time [rather than] just developing components of that software from their perspective, without really consulting and getting to the bottom of, ‘What are you guys using?… It was refreshing to see this setup. And them taking an interest in what advisors think.”

Successes

Unified product team: By working through feedback from advisers, product leadership in the business could get align on the strategic future of the product.

Uplifted customer engagement: Advisers felt motivated and engaged by the ability to speak about challenges with the software they used daily, in a safe and open forum.

Identified challenges and opportunities: The research with advisers created a clear list of challenges and opportunities, which gave the business a place to explore various futures for their software.

Challenge

In Australia, financial advisers act as mediators and advice-givers for people looking to manage their finances more effectively. As part of the federally mandated governance structure for financial advisers, they are required to provide an annual review to their ongoing advice clients.

Our client, a leading provider of financial advice software, wanted to explore advice reviews, with the hypothesis that there was an opportunity to make the experience easier to implement, more meaningful, and more valuable to both advisers and end customers.

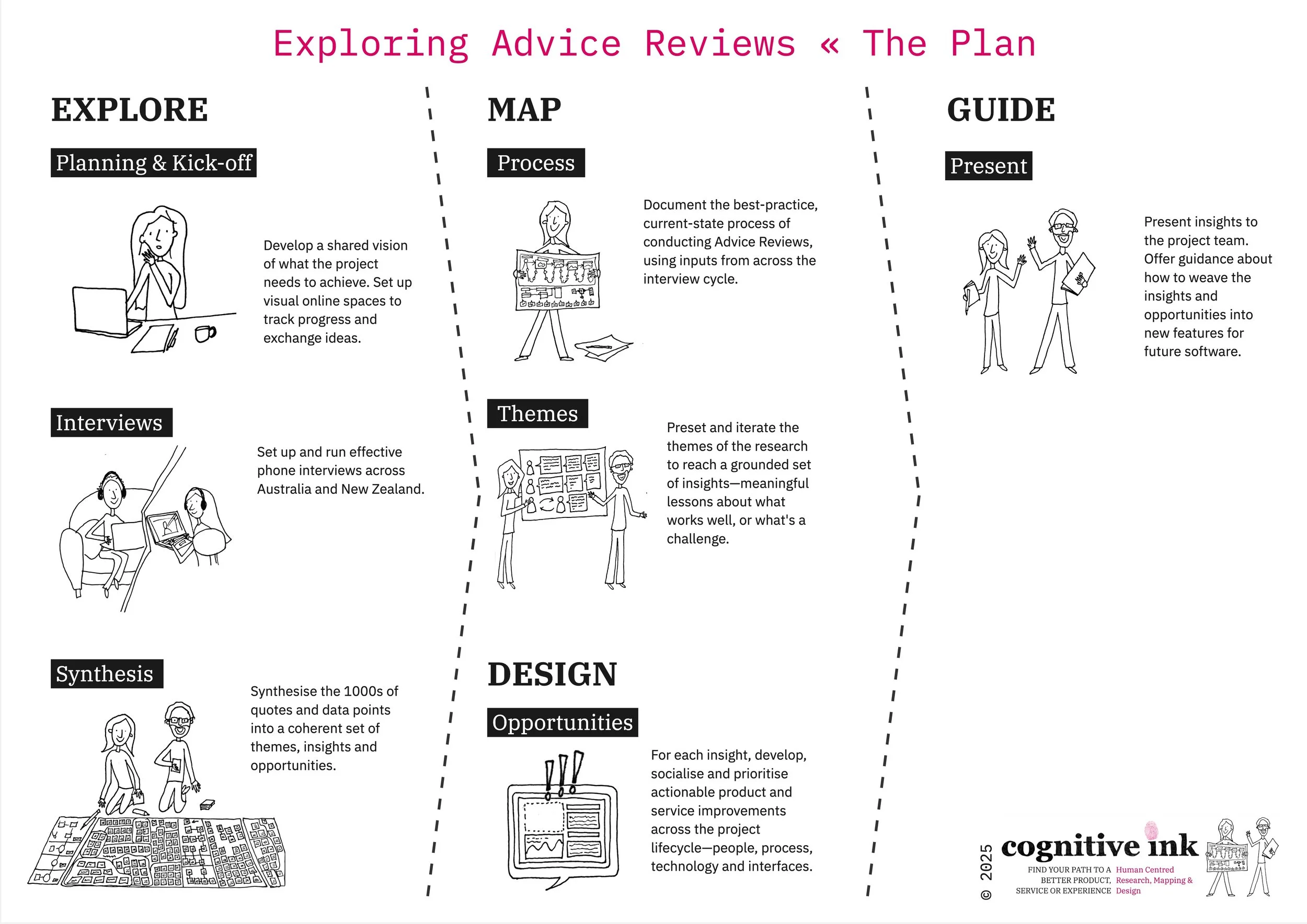

Approach & Deliverables

In order to capture the context-rich process of conducting financial advice reviews, in partnership with the client, we organised a series of behavioural interviews with 10 financial advice related experts. This included seven advisers, two financial planning assistants and one paraplanner. Advisers ranged in experience from five to 20+ years and had 20 to 150 clients.

The goal of the interviews was to get people talking—not just about their opinions—but telling stories of behaviour when they tried to solve problems. By anchoring on behaviour, the interviews dug into what people were trying to do and why they’re trying to do it.

Using a semi-structured interview format, we talked through the end-to-end review experience with advisers. We sourced specific review customers as examples and uncovered insights about the highs and lows of the process.

Along the way we captured activities, metrics, workarounds, behavioural insights, challenges, and opportunities. After all, you can turn challenges into opportunities, and workarounds are ideas for better processes, training, technology or experiences.

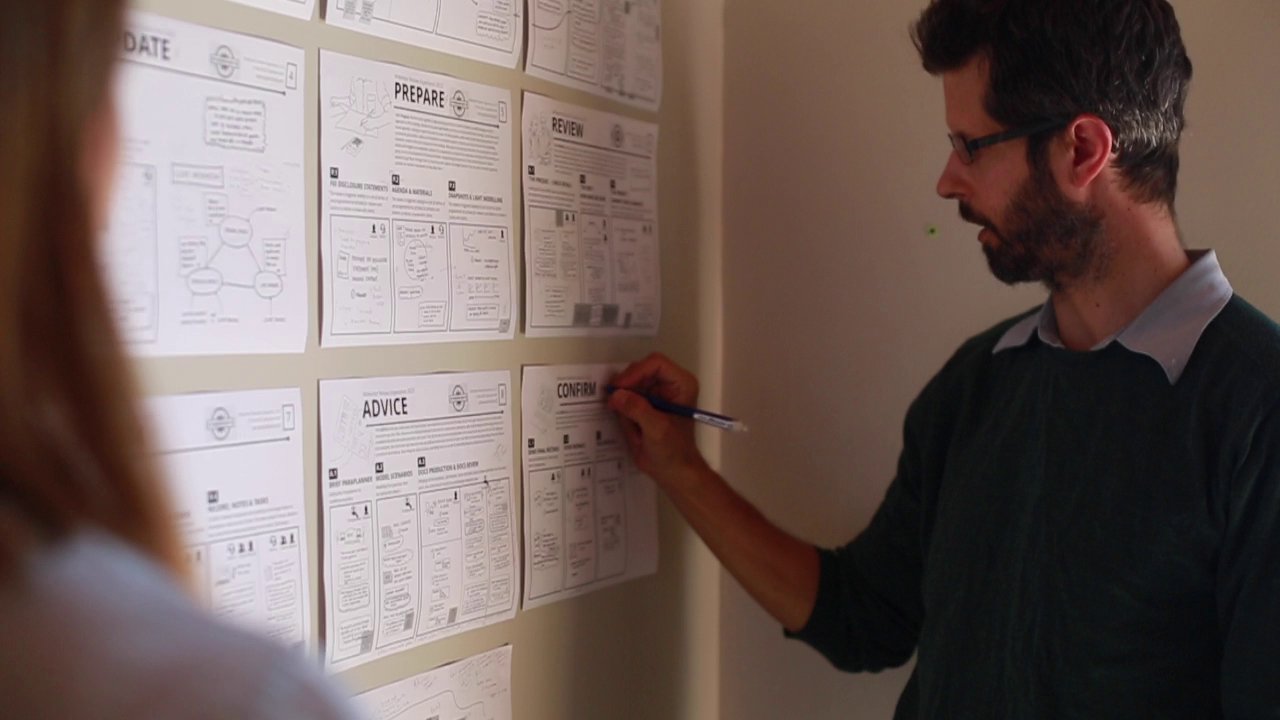

As part of the deliverables, we organized key insights into an end-to-end journey of the existing advice review experience.

We used cost-effective text-and-sketch based vignettes to prototype and communicate how parts of the experience could change.

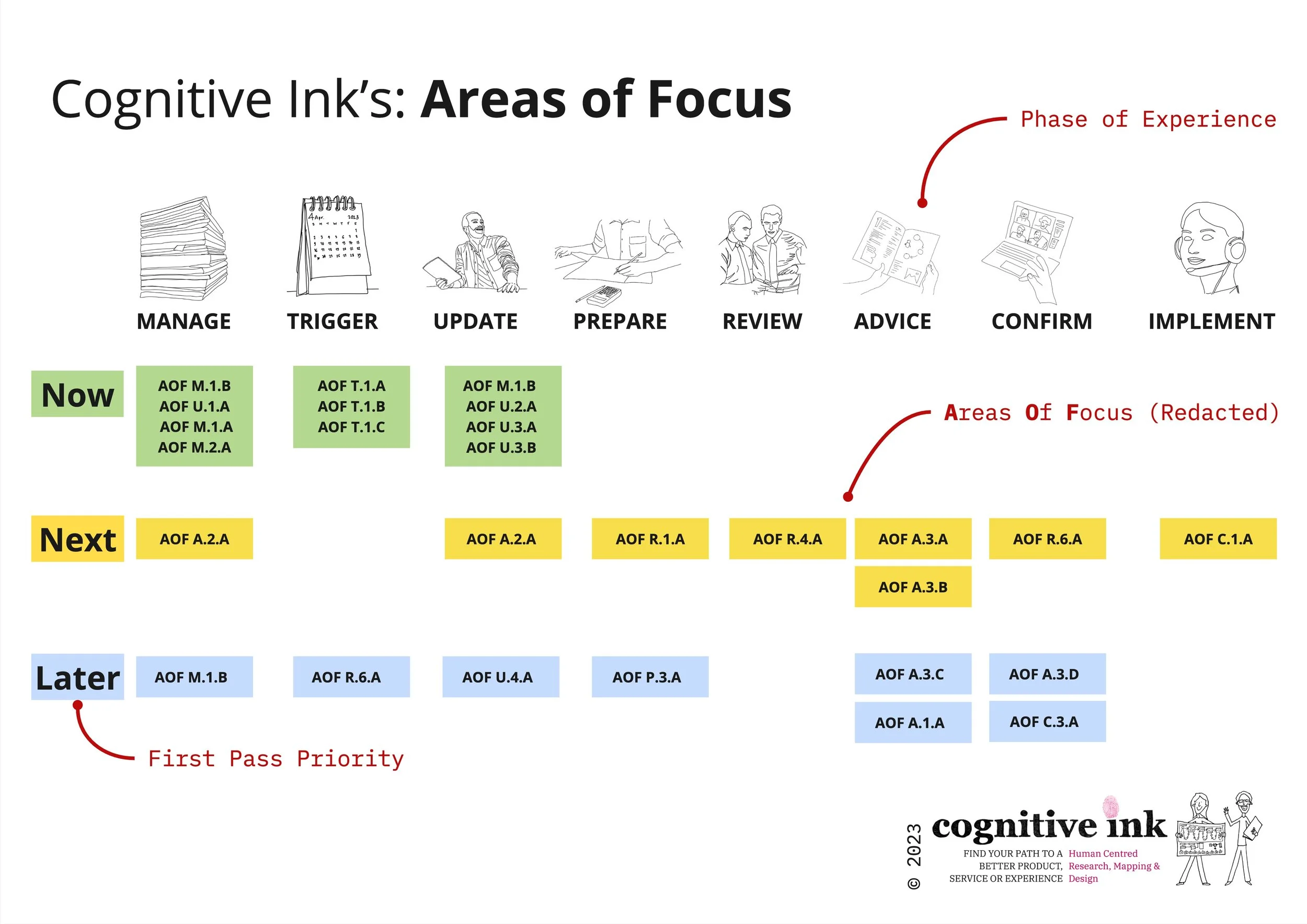

The key outcome was an organised and prioritised list of Areas Of Focus (AOFs). AOFs are a way of marking places in an end-to-end experience which need special attention. AOFs can create many types of change, including: better communication of existing features, making something easier to use, or adding a new features. And they can occur anywhere in the experience: front-end, in the service layer, back-of-house or even deep in the system architecture. What’s important is that improving an AOF represents an increase in performance, satisfaction or value. With guidance from Cognitive Ink, the team reviewed and prioritized Areas of Focus based on implementation complexity and potential impact on adviser or customer metrics.

Finally, during the entire delivery, because the team was working remotely, we organised all assets onto a virtual whiteboard to allow for real-time collaboration from multiple locations.

Insights & Outcomes

The interviews generated over 1,000 quotes, which, when organised, pointed to a complex set of strategies financial advisers use when dealing with a changing financial advice customer base.

Customers long in retirement and with locked-in strategies were giving way to more demanding, younger clients with less to spend on traditional models of advice.

It pointed the way towards software doing a lot more of the ‘heavy lifting’ to help prepare yearly facts and figures, leaving the adviser more room to explore changing strategies with customers.

We communicated the insights to both an adviser pilot group and the internal leadership, including the Head of Product, Chief Executive Officer, and other business leads within the company.

The research and service design outputs thrilled the client team, as they provided a new baseline for their future product strategy. As the Head of Product noted: “This is absolute gold when it comes to knowing what to do next and building a solid business case.”