Baked Beans or Caviar? Retirement Calculations Reimagined

How do you help people shape a better financial future?

With one of Australia’s leading financial advice software providers, we explored the challenge of helping people understand and plan for their retirement. Moving beyond basic and boring retirement calculators, we took people into a world where different choices (‘lifestyle levers’) could radically change their future retirement experience.

“The insights from the research were extremely valuable. Delivered above and beyond expectations. Loved working with you guys!”

Our work:

Identified ideal users: We helped the business identify a range of possible users, then prioritise those that would benefit from help and would also offer the business the greatest value.

Selected the most valuable features: Using human-centred research and design, we identified which features solved the most crucial retirement planning problems for end users and created the most value for the business.

Explored technical impact early: By bringing the technical leadership into the research and design processes early, we helped inform a technical architecture that would be achievable by the business.

Reduced the build complexity and cost: By providing and iterating a clear set of wireframe concepts, we provided a clear link from the rapid research into the detailed visual and user interface design process that followed our project.

Challenge

We’ve all heard the horror stories of pensioners buying cheap pet-food rolls at the supermarket, not to feed a well-loved dog, but to eat for their own dinner. Or of someone surviving on a daily diet of baked beans and toast. For someone struggling, retirement can be a confronting experience, especially when thinking about finances.

On the other extreme are the stories of retirees with multiple properties, jet-setting from location to location at whim. They have more than enough money for their needs, and may end up with vast unspent nesteggs.

Neither end of the spectrum represents effective retirement planning, something that the broad retirement ecosystem is growing more concerned about.

Imagine that you provide software to help both financial advisers and everyday people understand their financial position, through their lives and into retirement.

How do you help people across the range of financial capabilities, develop a practical and useful vision for their retirement?

Mathematically, you need to understand what income people will need over the course of their lives and into retirement.

That seems simple enough.

But there’s a catch.

People’s ways of thinking about their lives are different.

Though we may all have a few common assumptions, everyday people have different contexts, dreams, financial positions and points at which they begin to plan for retirement.

Also some people don’t plan on retiring completely, but want to enter retirement in a phased series of stages. Others want to finish their careers between one day and the next.

To help people think about retirement, you therefore need an experience that can adapt to different choices. One that teaches people about the lifestyle levers they can pull, based on different starting positions, and different possible futures.

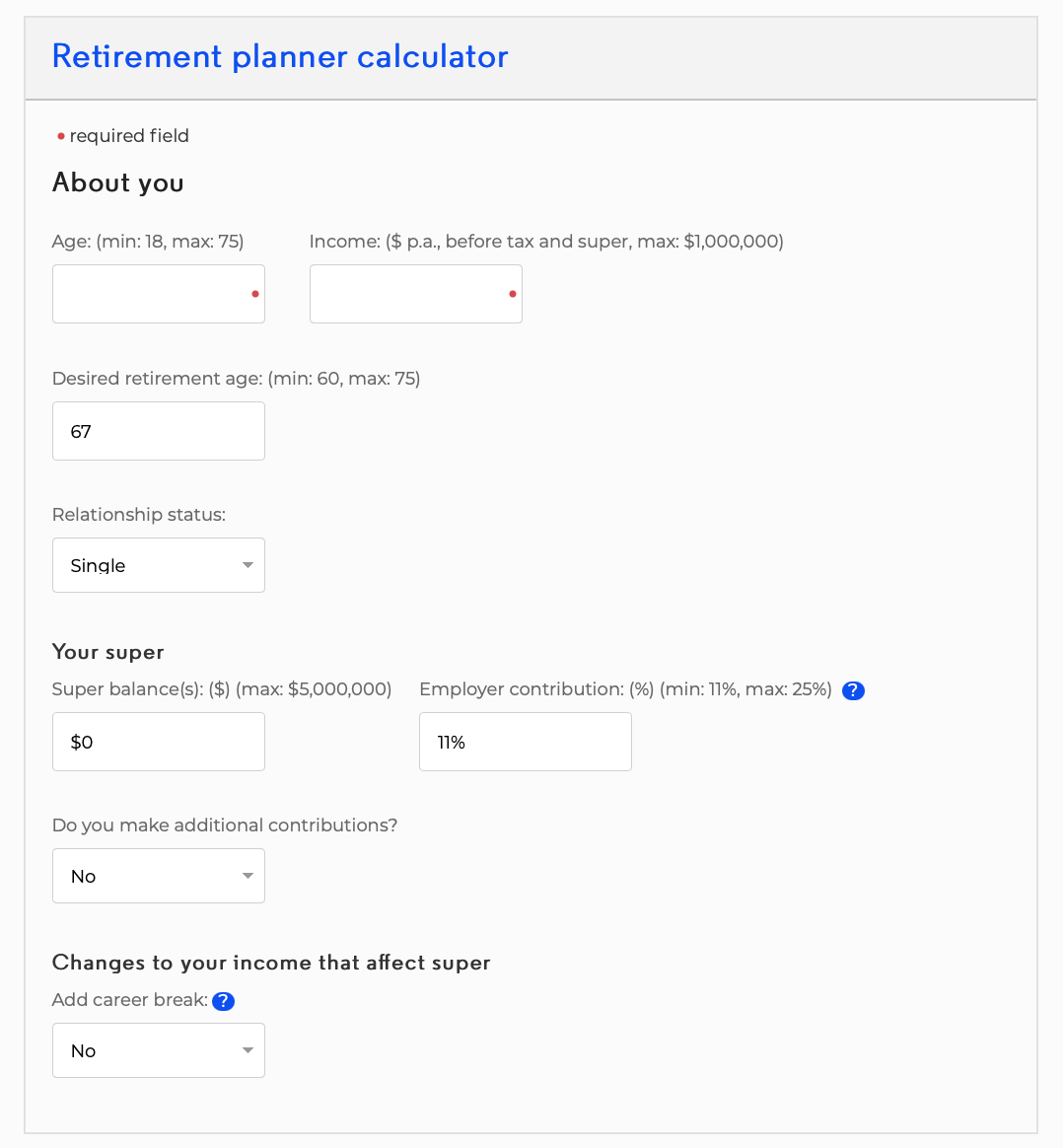

But have you seen a retirement calculator recently?

It’s death by form-fill.

Simple calculators may be suitable for a specific group of financially savvy ‘spreadsheet people’, but they’re not great for a general audience.

You need an experience that connects everyday choices to future impacts.

What would that look like?

With one of Australia’s leading financial services software providers, that’s exactly what we set out to discover.

Approach & Deliverables

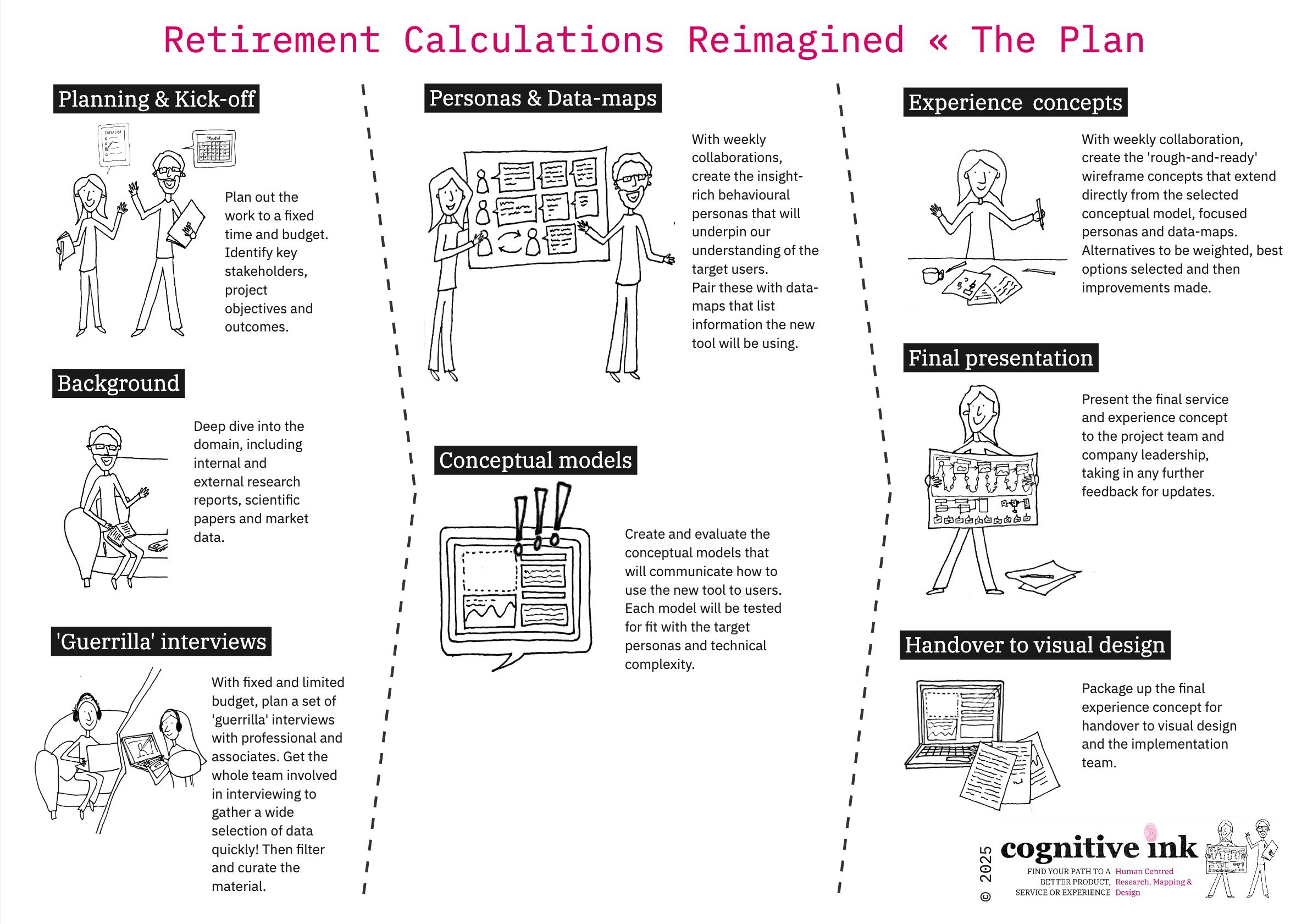

In collaboration with our client, we planned a week-by-week approach that made the best use of a tight timeframe and budget.

This focused plan allowed us, with help from the core client team, to gather a first round of feedback in just two weeks.

Our goal was to understand how people differ in thinking and planning their retirement. Then, we planned to turn that understanding into a set of rapid, simple and clear line-drawing prototypes for a new type of interactive retirement planning tool.

To ground the experience design with solid research, we focused on quality Personas and an underpinning Conceptual Model for the new experience.

’Guerrilla’ interviews

We needed to get new insight from everyday people thinking, or ignoring, their future retirement. But with a measured budget, and while working remotely, there wasn’t capacity for an extended, in-home or in-workspace interview sequence.

Instead, we arranged a series of rapid ‘guerrilla’ interview calls with contacts at various stages of retirement. Though limited, the insights were key in getting fresh feedback on how people were conceptualising retirement.

We also built materials that helped the people on the client-side team to conduct their own ad-hoc interviews and then curated insights from their work into our data-set.

This two-prong approach meant we got quick, cost-effective feedback to make better design choices.

Developing personas

Personas are a well-established design tool that describes how a group of people can share common behaviours, goals and constraints.

A well-constructed persona uses real-world behaviour, statistics and other research to help design teams see the world from different points of view.

For this project, we developed nine behaviourally anchored personas, covering a range of financial positions and ages. Of these, we selected four personas who would benefit most from the new tool.

The personas were paired with lightweight data-maps of the information people needed to supply to make good decisions about retirement, the actual field-level detail that they’d need to manipulate.

Together, personas and data showed who we were building for, and what data they’d need to work with.

Which left us to pick a conceptual model that would help people figure out how to build a practical and positive understanding of retirement.

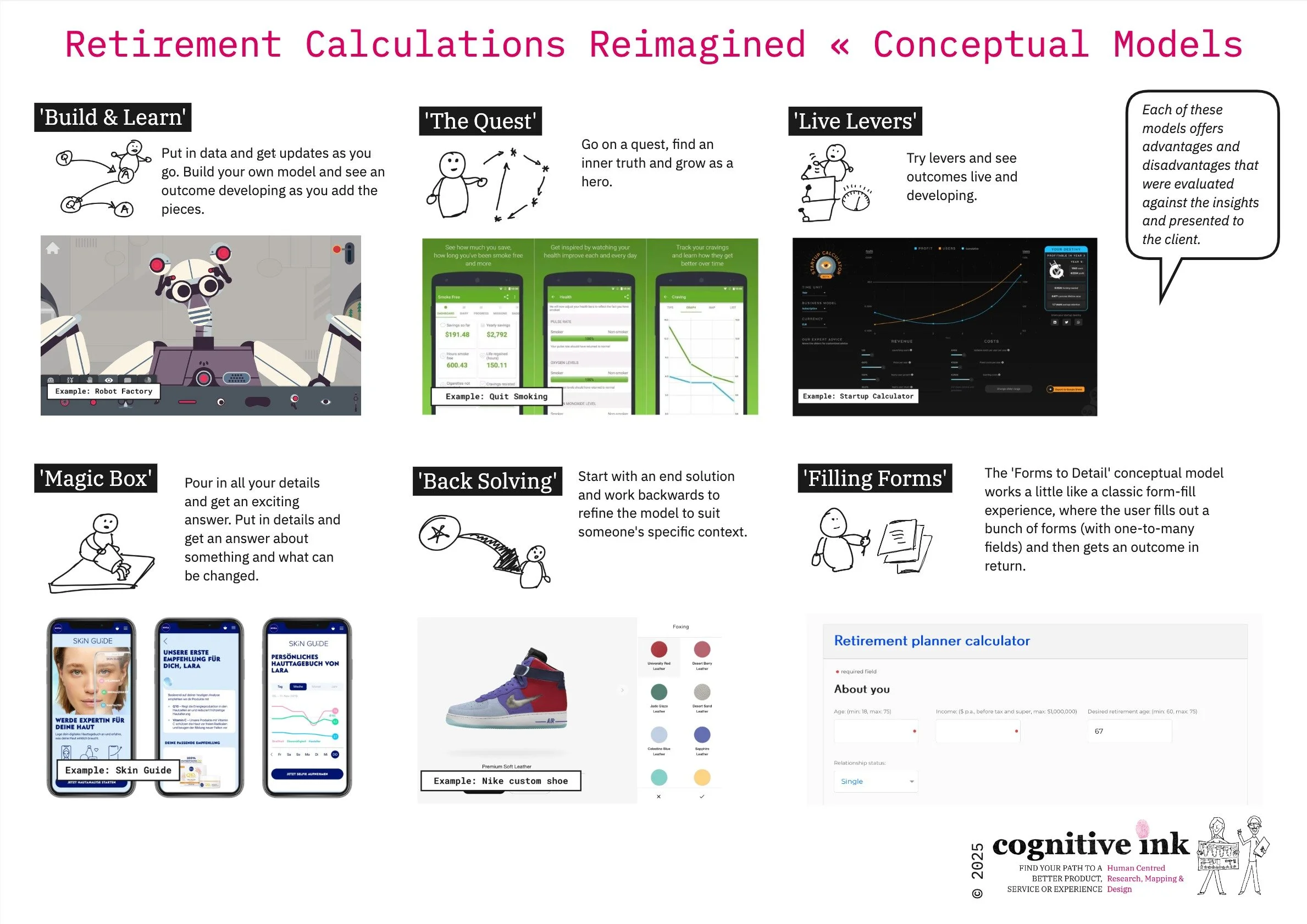

Grappling with a conceptual model

A conceptual model is the underpinning ‘idea’ of how system works. It’s a way of organising someone’s actions with a product, service or experience. Like how we use ‘a set of pages in a column’ as a conceptual model for computer-based word processing.

High-performing experiences come from conceptual models that match how people think about a task, or they help teach people a better way to think about a task. Without an excellent model, products, services and experiences often feel confusing.

Based on our research and experience with many of useful design patterns, we identified seven possible conceptual models.

Through several analysis and feedback cycles, we picked one of the seven models that provided the best underlying pattern for the design solution.

Simple but effective wireframe concepts

Using the personas, data maps and conceptual model, we iterated several rounds of clean, black and white, line-based wireframes to design a new online retirement planner.

Using lightweight prototypes allowed us to iterate quickly, without the distraction of a final look-and-feel.

Our final set of wireframes accounted for all key personas, used a solid conceptual model, and included the data required at field level.

They were also easy to turn into final visual designs, using a graphic design resource working with the client following on from our work.

Insights & Outcomes

Turns out, the very concept of retirement, though usually marketed as an idyllic, golf-playing period of relaxation, is far more complicated than that.

For younger people, retirement is a changing construct; not a single date at which life changes, but a phased approach to a set of personal, social and economic changes. The younger people are, the more distant the concept of retirement and the less clear the money that is required.

There are distinct patterns in people’s needs and their confidence in facing their future. Needs are not always based on age, but also on people’s different starting positions. This includes how early they begin to plan for retirement and whether they encounter any setbacks along the way.

The retirement system assumes people will own their own homes, but this looks less certain into the future. This increases the amount of financial buffer someone needs to achieve their goals. In contrast, those with more assets were surprisingly fearful, struggling to let go of ever-increasing nest-eggs.

Our proposed solution helped key user groups work from a personalised starting position to their own vision of an ideal future, while still achieving balance.

We organised our outputs into an easily shareable online and offline report that included the research, insights and concepts.

Then we presented our concepts to team members across both the business and technical leadership of the company.

Because we’d involved the team along the journey, there was strong organisational ownership over the ideas and they were very well received.

The project served as a crucial foundation for further detailed visual design on the concepts, as well as a lead-in to building the business-case to take the concepts into pilot and production.