How to Give Financial Advice to More People? Solving the Riddle with AMP Goals 360

Financial advice is both expensive and confusing for most Australians. So how do you make advice more accessible?

Working with AMP Bank, one of Australia’s oldest financial institutions, we joined the Goals 360 project, with work that spanned several years. Christopher provided Lead Service Designer support to an industry-leading Design & Innovation Team, led by noted innovation specialist Dr Munib Karavdic.

Key stakeholders had this to say about the work:

“Over the last two years I’ve had the pleasure of working closely with Christopher to transform the way we provide financial advice. Christopher has shown exceptional design thought leadership with proven ability to support blue-sky design through to detailed service design. Thanks to Christopher’s design prowess we now have a product in market, raising NPS scores from advisers and customers and a demand we’ve never seen before! I can’t wait to work with Christopher again.”

“Chris’ service design experience, understanding of the current financial advice paradigm and perseverance was invaluable as our teams set out to help consumers make great life choices through technology and human empathy.”

The work:

Explored the experience benefits and impact, of cutting-edge technologies: The team rethought the existing financial advice experience by using the capabilities offered by new complex modelling technologies.

Developed new business models: Helped AMP develop new business models and a business case, based on qualitative and quantitative evidence.

Shaped the Goals 360 experience: Based on primary customer and adviser research, provided guidance on how to make a better product and service experience, including shaping technology, process, people and experiences.

Connected legislation to experience design: Financial advice in Australia is governed by many rules and standards, the pre-eminent of which is Customer Best Interest Duty. Helped shape the Goals 360 experience to work in line with the regulatory standards from ASIC, the Financial Service Regulators and othr laws surrounding finance and banking.

Multiple award wins: In 2018, the AMP Goals 360 project won three Good Design Awards, including awards in Service Design (Winner), Design Strategy (Best in Class) and Digital Design Interface (Gold Winner). Also in 2018, the program won the Chant West Best Fund award.

Challenge

We’re all used to receiving advice.

We get advice on what to eat in a restaurant, what to watch and what property to buy. We get advice on how to fix or improve our appearance, our fitness and our health.

Yet, by-in-large, Australians rarely get financial advice. As of the mid-2010s, only ten percent of Australians made use of a financial adviser.

The industry has suffered through several high-profile failures of customer best interest. It takes a bold vision to work out how to change such an incumbent industry.

With the Goals 360 program, AMP set out to rethink financial advice. The project required a tremendous Human Centred Design led program of technology, business, learning and change management.

According to AMP’s overarching brief: ‘We want to reinvent financial advice to be accessible and valuable to all Australians.’

Approach & Deliverables

Over a two-year period from 2015 to 2017, Christopher spent extensive time onsite at AMP, and in the field, to provide lead Design Research, Experience Strategy, Facilitation and Service Design support to the AMP Design & Innovation team.

Because of the special scale, size and complexity of this project, the work included a wide range of Experience and Service Design activities, including: co-design and concept testing with customers and advisers, dozens of in-depth customer interviews, onsite ethnography with advisers, full-scale (wall-spanning) service blueprints, storyboards, business model innovation and hundreds of hours of customer testing and workshop facilitation.

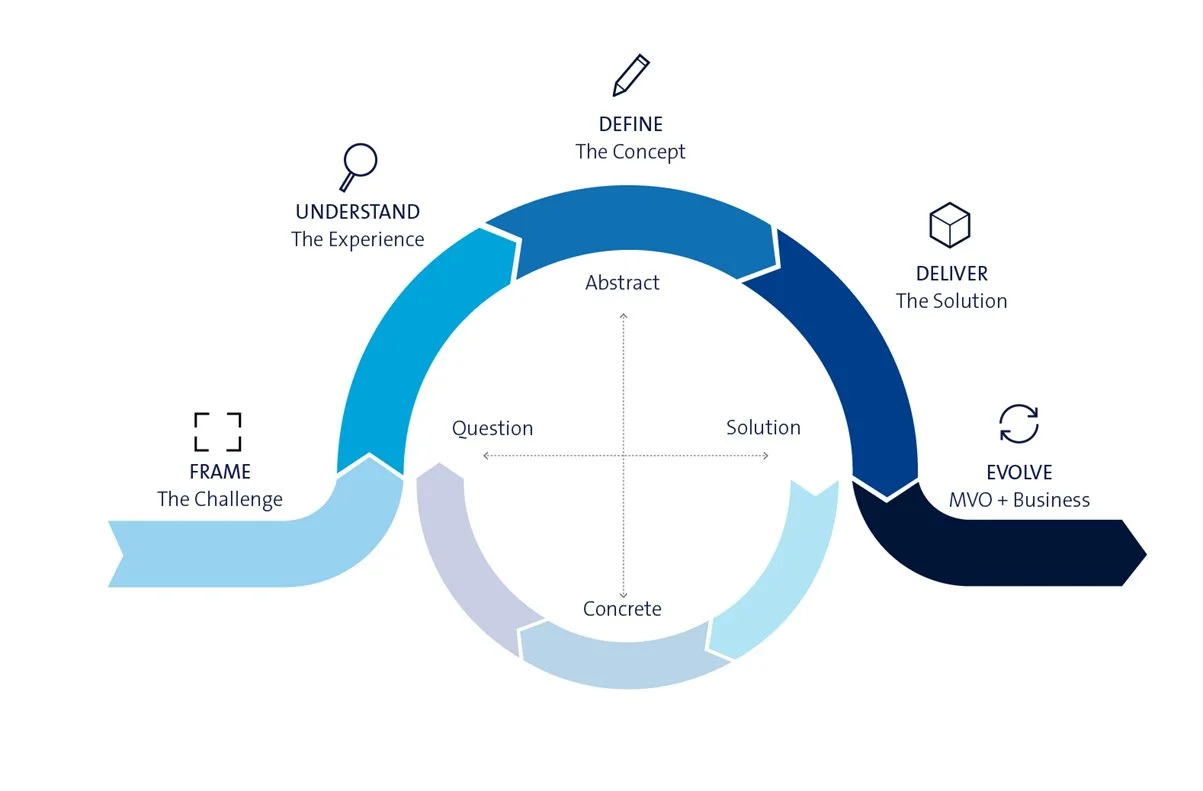

In order to deliver such a large-scale mandate of work, within the larger program, Design & Innovation leads were assigned a series of key research ‘pods’ that broke down the end-to-end, top-to-bottom advice experience. Each pod would conduct spikes of research, design and testing work to Frame, Understand, Define, Deliver and Evolve a section of the experience.

Christopher led a range of pods, including: Best Interest Duty, Advice Exploration and Review. Goals Exploration and Tracking, Financial Health Checks, Advice Paraplanning and Advice Value.

The service design outputs, expeirence specifications and frameworks were fed into detailed design and delivery teams, which produced the technology (software and hardware), processes, training, collateral, roll-out and fit-out required to deploy the experience into AMP advice offices.

Insights & Outcomes

Here’s an authentic story about advice, drawn from years of notes. *Names, details and descriptions were obscured or altered for privacy reasons.

Victoria* is a stay-at-home mother with two children. She has extensive experience in customer service and a goal to return to her role when her children grow older. She is aware of what she knows and does not know about her finances.

She understands financial advice, at least in concept. In the past, a family member referred her to a financial planner, but she hasn’t visited them yet.

Her hesitation speaks to deeper concerns.

Victoria wants a wonderful future for her children, which means knowing she is both living within her means and planning for the future. Yet, this desire still isn’t enough to get her to get help.

The biggest barriers seem to be cost and trust. To her, financial advice is expensive for the value it appears to offer. She also doesn’t know whether a Financial Adviser will help her, given she doesn’t have a great deal of money to spend.

But she still has dreams.

A good life isn’t actually about the money, or rather, it isn’t all about the money.

Money is a means to chosen ends, a way of achieving personal goals. People spend a lifetime exploring and re-assessing what goals they want to achieve, their priorities changing, based on life events.

People aren’t looking for someone to tell them how to live. However, they are looking for someone they can trust to tell them how best to achieve their goals—and what is practical or impractical about what they want to achieve based on their means.

To be human-centric in financial services, you have to start with the person, not the financial products.

With this aim, the AMP Goals 360 service was officially released to the market in December 2017.

It delivered: “Tailored cash-flow, debt, wealth protection and other wealth management advice strategies generated in real time and presented through a seamless, interactive digital experience, developed using human-centred design.”

In 2018, AMP Goals 360 won three Good Design Awards, including awards in Service Design (Winner), Design Strategy (Best in Class) and Digital Design Interface (Gold Winner).

As of the time of the award in 2018, 32 advice practices had taken on the new experience. This meant 1,988 customers became part of the Goals 360 journey with 12,285 customer goals being developed.

As noted by one customer, “I can see when goals are achievable, how easy or hard they are, and what’s realistic.”

Projects of the scale and vision of AMP Goals 360 come rarely. This was an opportunity to make a change in the financial services industry that really mattered and we were excited to be part of it.