Helping people shape themselves a better future, by understanding the impact of lifestyle choices on retirement.

What sort of context helps people make sense of the ‘abstract numbers’ that surround retirement costs?

“The insights from the research were extremely valuable. Delivered above and beyond expectations. Loved working with you guys!”

Working with one of Australia’s leading advice software providers, we explored how people think about and understand their retirement. With a tight time-frame and budget, we designed and recruited for a series of ad-hoc ‘guerrilla’ interviews across the organisation. Using people inside the organisation to help, we were able to gather a basic round of feedback in just over two weeks.

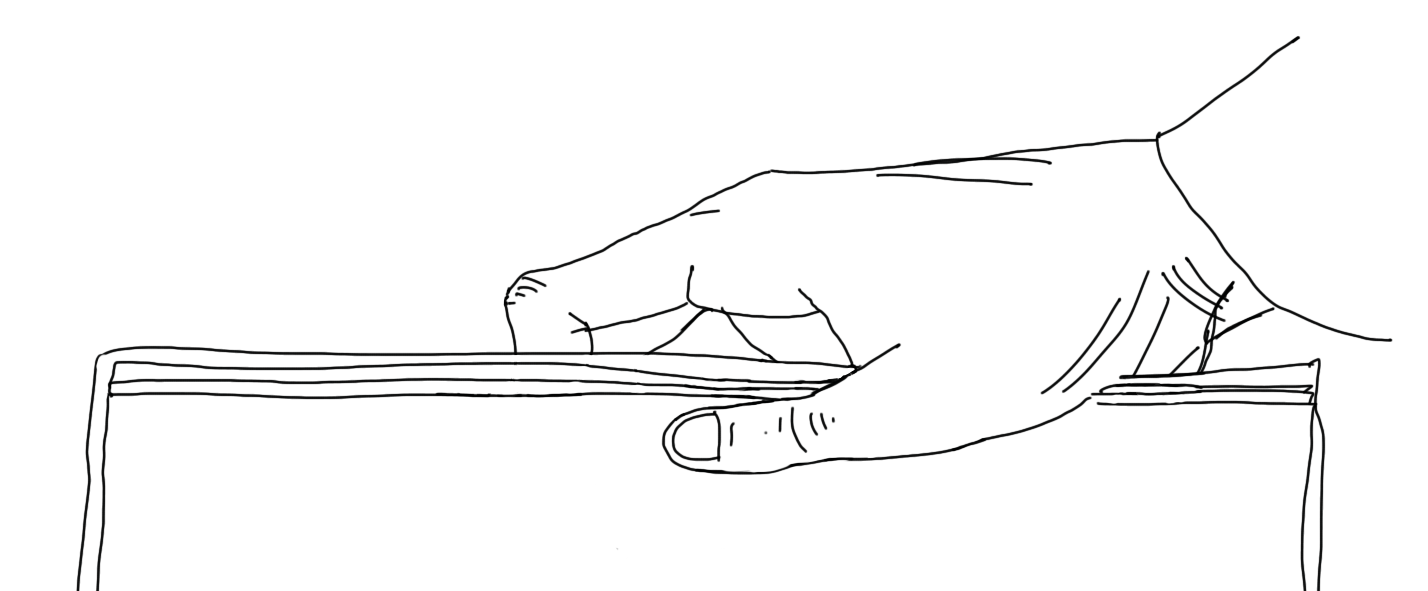

Synthesising the results into a set of behavioural insights and personas we learned how people plan for retirement, how they make sense of the ‘abstract numbers’ that indicate how much they’ll need to save and how they make choices about what lifestyle they want to aim for. Part of the thrill of the project, was exploring various conceptual models that help people ‘pull the levers’ of lifestyle to plan out what their retirement could look like, in contrast with what their financial capabilities were today and into the future.

Not only did we present our work in a series of weekly co-design ‘stand-ups,’ our final concepts were presented to the Head of Product, Head of Technology and Chief Operations Officer of the organisation.

Ultimately, the service journeys and high-level prototypes formed the backbone of the design for a new retirement calculator that helped people start from a vision of what lifestyle they want to lead and work backwards toward what they need to do today to achieve it.